- How we ranked the mountain markets

- 1. Sevierville & Pigeon Forge, Tennessee

- 2. Blue Ridge, Georgia

- 3. Helen, Georgia

- 4. Branson, Missouri

- 5. Winter Park, Colorado

- 6. Keystone & Copper Mountain, Colorado

- 7. Mammoth Lakes, California

- 8. Angel Fire, New Mexico

- 9. Ruidoso, New Mexico

- 10. The Poconos (Albrightsville), Pennsylvania

- 11. Hochatown (Broken Bow), Oklahoma

- 12. Lake George, New York

- 13. Deep Creek Lake, Maryland

- 14. Roanoke, Virginia

- 15. Bryson City, North Carolina

- Conclusion

A cabin that pays its mortgage after just one week of peak bookings isn’t a fantasy. Recent market data shows it’s already real in several U.S. mountain markets, with the Poconos topping the chart for yield-per-dollar invested.

But revenue means little if the local permit evaporates when you close; many investors learn that lesson after city hall shuts the door.

Our six-pillar scorecard pinpoints 15 towns where solid cash flow pairs with licenses that transfer cleanly—giving you confidence to buy, hold, and eventually sell.

How we ranked the mountain markets

Great rental numbers alone don’t earn a town a spot on our list. We built a six-pillar scorecard that blends profit potential with practical staying power, because the sweetest ADR means nothing if a permit freeze kills your booking calendar.

First, we captured Revenue Potential. We pulled annual income, average daily rate, and occupancy from AirDNA and Airbtics, then weighed that slice at 30 percent of the final score.

Second, we graded License Ease and Transferability at 25 percent. Towns that offer unlimited or grandfathered permits scored high; places with caps, lotteries, or owner-specific licenses slid down the chart.

Affordability came next. A modest home price often beats a glamorous rate when you’re calculating yield, so Median Purchase Cost counted for 15 percent.

We then added Tourism Demand and Growth (visitor stats, new attractions, airport access) for another 15 percent.

Long-term upside matters, so Equity Appreciation received a 10 percent nod, driven by five-year price trends and migration patterns.

Finally, we layered in a 5 percent Risk Check for wildfire exposure, shoulder-season drop-offs, and any local talk of tightening rules.

Only towns that cleared a minimum threshold on every pillar, and still let a license pass smoothly from seller to buyer, made the cut. That’s how we move beyond pretty pictures and into investments that keep paying you back year after year.

1. Sevierville & Pigeon Forge, Tennessee

Smoky-Mountain cash-flow royalty

Smoky Mountains cabin rental landscape in Sevierville and Pigeon Forge.

If you judge a market by raw dollars, the Smokies win by a mile. Families pour into Sevierville, Pigeon Forge, and nearby Gatlinburg for Dollywood, dinner shows, and the country’s most-visited national park. That steady traffic keeps calendars green almost year-round.

Vacasa’s 2025 buying report pegs the median cabin at about $483 000 and typical annual rental income near $42 800, good for a cap rate north of six percent. Owners who add a game room or a panoramic hot-tub deck often double that figure.

What seals the deal is the county’s permit policy. Secure an overnight-rental license, keep it current, and it rides with the property when you sell. No cap, no lottery, no sleepless nights about a future moratorium. City zoning still matters, so we always verify a cabin’s map square before writing an offer.

Demand keeps surging. Great Smoky Mountains National Park welcomed more than 12 million visitors last year, and Sevierville’s airport expansion is bringing in even more flyers. A quick scan of AirDNA shows many three-bedroom cabins crossing $50 000 in gross bookings without premium pricing.

Risks exist: fierce listing competition and rising insurance on woodland homes, but cash flow still eclipses those headaches. For investors who want high occupancy, transferrable permits, and zero state income tax, the Smokies remain the gold standard.

2. Blue Ridge, Georgia

Rustic luxury, Atlanta-sized demand

Two hours north of Atlanta, Blue Ridge has become the weekend cabin capital of the Southeast. Visitors stroll its postcard Main Street, ride the scenic railway, and unwind on hot-tub decks that overlook uninterrupted treetops. That four-season pull keeps calendars humming well beyond leaf season.

Cabins typically cost about $420 000, while a three-bedroom grosses around $50 000 a year. Those numbers translate into cap rates that rival beach condos, yet owners avoid hurricane insurance and enjoy Georgia’s lack of state income tax.

Permitting stays simple. File once with the city or county, post local contact details, and remit the hotel tax. No license cap exists, and officials show no appetite for one, so a future sale will not trap the next owner.

The main challenge is standing out in a growing inventory. Add a firepit, a game loft, and that must-have mountain-view hot tub, and you will stay ahead of the pack while tapping Atlanta’s expanding pool of road-trip renters.

3. Helen, Georgia

Bavarian charm, festival-fueled profits

Helen, Georgia Bavarian-style mountain town main street.

Helen looks like it landed from the Alps, lederhosen and all. That quirky façade lures about 3 000 000 guests each year for summer tubing, fall leaf-peeping, and one of America’s largest Oktoberfests. Each season carries its own headline, so weekends rarely sit empty.

Cabins still sell near $350 000, giving investors an attractive revenue-to-price ratio. Market data ranks Helen among the quickest markets to cover a mortgage: roughly seven rental nights per month does the job.

City hall keeps permits simple. File a business-license form, pay the hotel tax, and you may host without a cap or lottery. Licenses renew annually and transfer to the next owner.

Inventory is scarce because the town is small. Secure a chalet within walking distance of the biergartens, add a hot tub under string lights, and Oktoberfest bookings will handle a large share of your annual revenue.

4. Branson, Missouri

Budget buy-in, Broadway-style demand

According to 2025 data from Taney County Tourism, about 9 000 000 visitors arrive each year for live shows, Silver Dollar City, and lake days on Table Rock. That steady carousel of entertainment flattens seasonality and even fills mid-week calendars.

The entry ticket stays low. The median purchase hovers near $215 000, while a three-bedroom cabin or condo often grosses around $30 000 a year, delivering cap rates in the double digits.

Licensing feels like a box-office pickup. The city grants nightly-rental permits on demand, requires routine safety checks, and stops there. No citywide cap, no neighbor veto, and permits transfer smoothly when properties change hands. Most resorts were built for vacation use, so HOA rules usually welcome short-term rentals.

Your task is to stand out in a crowded playbill. Guests look for theater-district proximity, plenty of beds, and a game room for rainy afternoons. Bundle those features, price competitively, and Branson’s steady stream of showgoers, anglers, and reunion groups will handle the rest.

5. Winter Park, Colorado

Rockies revenue, bureaucracy lite

Winter Park serves Denver skiers by day and mountain-bike enthusiasts all summer, yet property prices still sit about 40 percent below Vail. That gap is pure upside for investors.

A two-bedroom slopeside condo often books roughly $42 000 a year while costing about $600 000. Cap rates land between 6 and 8 percent even after a full-service manager takes a cut.

Best of all, the town issues renewal-based licenses that new owners can secure in a single form. Unlike neighboring Fraser, which recently implemented a cap, Winter Park remains open for business. No waitlists, just a quick inspection and you are hosting.

Revenue can dip during mud season, so smart owners use dynamic pricing to capture peak winter holidays and summer festival weekends. Follow that playbook, and Winter Park’s mix of approachable prices and reliable permits becomes hard to match in Colorado’s otherwise tightly regulated ski belt.

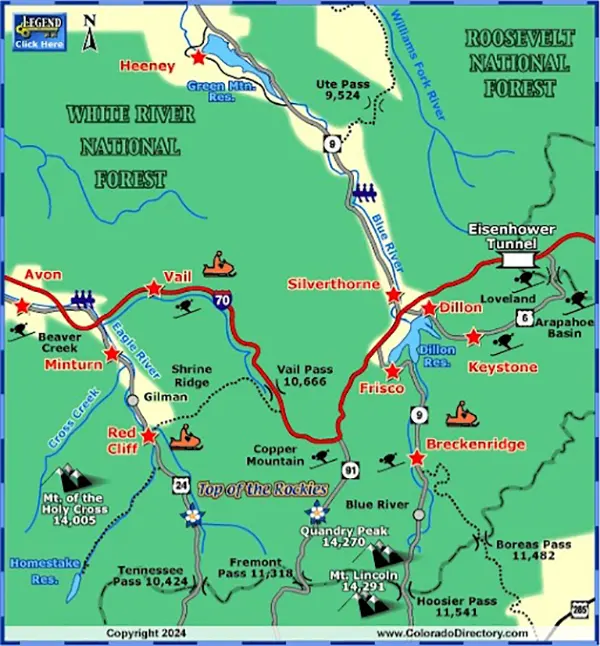

6. Keystone & Copper Mountain, Colorado

Local data underscores those projections.

SkyRun Vacation Rentals—which runs full-service offices in both Keystone and Copper Mountain—reports that a two-bed Cinnamon Ridge condo it manages netted $42 152 last year, a 25 percent jump after the owners switched from another firm.

Across its Keystone portfolio, SkyRun’s listings are booked 2.4 times more often than the average property on major channels, so the 60-plus-percent occupancy baked into our cap-rate math is realistic.

Resort-zone freedom in a big-name county

Summit County tightened neighborhood rental rules, yet it carved out special Resort Zones at Keystone and Copper. Inside these borders, nightly hosting is a protected land use, so licenses remain unlimited and renew with a quick online form.

Summit County Colorado Resort Overlay Zone map for Keystone and Copper.

Demand stays strong. Keystone offers night skiing and year-round conferences, while Copper hosts pro ski camps, summer music festivals, and a full mountain-bike park. A two-bedroom village condo often grosses about $50 000 a year on a purchase price near $650 000, placing cap rates around 6 percent for blue-chip ski real estate.

Costs are predictable. HOA dues run high, yet they include shuttles, snow removal, and hot-water heat, preventing surprise invoices when a blizzard hits. Guests cover a 14 percent lodging tax, so your net math stays clean.

The playbook is simple: buy inside the resort boundary, confirm the HOA welcomes short-term rentals, and furnish for families with a bunk room plus ski-locker perks. Follow those steps, and you gain Vail-level traffic without Vail-level red tape.

7. Mammoth Lakes, California

Sierra nights at premium rates

Mammoth Lakes ski resort village and mountain backdrop.

Mammoth is one of the few mountain towns that sells out both July trout season and April powder days. The ski hill often stays open into June, then becomes a Yosemite gateway once Tioga Pass clears. That split schedule pushes winter nightly rates above $400 and still about $250 in summer.

Condos in the resort core list near $800 000, a steep sticker but still profitable because gross bookings often top $70 000. Industry data shows owners netting more than $300 for every occupied night, making Mammoth one of the nation’s fattest margins.

Regulation centers on zoning. Buy in the Village or any complex tagged “Transient Use” and hosting is a protected right. Permits are unlimited, renew annually, and transfer as smoothly as updating the TOT certificate.

Shoulder months stay quiet, and heavy snow raises utility bills, yet the numbers still work. A dozen peak weekends can cover mortgage, taxes, and HOA fees before summer hikers even arrive. Mammoth remains a high-price, high-yield play for investors who want West-Coast reach without West-Coast bureaucracy.

8. Angel Fire, New Mexico

The ’Easy’ Button for Southwest Ski Investing

While neighboring Taos battles investors with strict permit caps, Angel Fire rolls out the red carpet. Located just 45 minutes east on the Enchanted Circle Scenic Byway, this resort town offers similar high-altitude powder and summer mountain biking but with a fraction of the regulatory headache.

Prices here are a steal compared to the Rockies. You can still find ski-in/ski-out condos in the three-hundreds and large chalets for under six hundred. With annual gross revenue often hitting 10-12% of the purchase price, the cash-on-cash returns are among the best in the Southwest.

The Village of Angel Fire requires a simple business registration and safety inspection. There is no numeric cap on permits, and the process is designed to be completed in days, not months.

The trade-off is amenities; Angel Fire is quieter than Taos. But for families who want affordable skiing and investors who want zero stress, it’s the smarter buy. Stock your cabin with board games and a high-end coffee bar, and you’ll capture the overflow of guests priced out of the bigger resorts.

9. Ruidoso, New Mexico

Four seasons, friendliest permits in the Sierra Blanca

Dallas families escape triple-digit heat here in July, while West Texas skiers return in January for Ski Apache’s 12,000-foot runs. Add fall horse racing and spring hiking, and Ruidoso fills calendars in every quarter of the year.

Homes stay attainable at roughly $300,000 for a pine-scented three-bedroom, and gross bookings often top $30,000. That cushion covers management fees and a wildfire insurance rider without sinking your cap rate.

Village leaders follow a “manage, don’t ban” model. Permits are unlimited, renew annually, and transfer after a routine safety inspection. The latest ordinance even requires a NOAA weather radio on site—evidence they want safer rentals, not fewer.

Wildfire risk is real, so budget for defensible-space trimming and higher coverage premiums. Pair that with a reliable local cleaner, and Ruidoso rewards you with steady, year-round bookings in a market many investors still miss.

10. The Poconos (Albrightsville), Pennsylvania

East Coast Yield King

While some Pennsylvania boroughs like Jim Thorpe have tightened rules, the private communities of Albrightsville and Towamensing Trails remain the undisputed heavyweights of East Coast cash flow. Located minutes from Big Boulder Ski Area and Hickory Run State Park, these HOA-governed neighborhoods were practically built for vacation rentals.

Property values are incredibly resilient. A renovated three-bedroom chalet often sells near $300,000, yet average nightly rates hover around three hundred. AirDNA data consistently shows this zip code delivering some of the highest yields in the Northeast, often covering the mortgage with just peak summer and winter bookings.

Regulation here is handled largely by the HOAs and Township zoning, which are well-established and stable. You register the home, pay the fee, and follow the noise/parking rules. Because the entire community economy relies on tourism, the risk of a sudden ban is significantly lower than in residential boroughs.

The key is amenities. In this competitive market, you need a hot tub, a fire pit, and a game room to hit the top revenue tier. Nail the design, and Albrightsville turns a budget buy into a portfolio workhorse.

11. Hochatown (Broken Bow), Oklahoma

The Billion-Dollar Backwoods

If you haven’t heard of Hochatown, you’re missing the fastest-growing STR market in the central U.S. Located at the doorstep of Broken Bow Lake and Beavers Bend State Park, this area draws millions of affluent Texans for luxury cabin stays.

The numbers are staggering. New-build luxury cabins often trade for $600k to $1M, but they generate gross revenues that can exceed $100k annually. Unlike Hot Springs, AR, which has capped residential permits, Hochatown is an unincorporated area (and newly formed town) built specifically for tourism.

Permitting is virtually non-existent in terms of restrictions. There are no caps and no zoning battles because nearly every cabin is a rental. You simply handle your lodging taxes and safety protocols.

The inventory here is high-end—think 30-foot ceilings, massive decks, and indoor slides. To compete, you can’t just buy a house; you have to buy an experience. But for investors willing to play at that level, the occupancy rates are the envy of the industry.

12. Lake George, New York

Adirondack summers, permit peace of mind

Lake George Adirondack lakefront with boats and mountains.

When July arrives, Lake George feels like the Hamptons with hiking boots. Weekly lakefront stays often top $1,500, and open slips at the marinas are rare. Foliage drives and winter carnivals stretch earnings past Labor Day, giving owners three profit spikes instead of one.

Purchase price hinges on shoreline. Off-water three-bed homes sell between $350,000 and $400,000, while modest lake-access cottages can reach $800,000. A prime eight-week summer can gross about $30,000 on its own, and shoulder seasons add another $10,000 to $15,000.

Local governments welcome that influx within clear rules. Both the village and town require short-term permits, yet set no numeric cap, and approvals stay with the property. Renew the license, meet occupancy and parking rules, and your buyer inherits the same rights.

Seasonality is the main hurdle. High summer rates fund the year, so wise owners bank a winter reserve and court off-season guests such as bridal parties, anglers, and ice-castle tourists. Master that rhythm, and Lake George’s clear water can keep your cash flow equally transparent.

13. Deep Creek Lake, Maryland

Two-season workhorse for the Mid-Atlantic

Deep Creek earns revenue in flip-flops and snow boots alike. Families reserve lakefront chalets from July through Labor Day, then the same houses trade paddleboards for skis once Wisp Resort powers up its lifts.

Garrett County values that tourism income, so it keeps licensing simple. Any home that passes a safety inspection receives a Transient Vacation Rental Unit license, and the next owner renews it with a quick form. No caps, no lotteries, no surprises.

Prices shift by shoreline yet stay approachable. A four-bed lake-access chalet priced near $500,000 can gross about $55,000 a year, pushing yields toward 10 percent even after hot-tub service and HOA dues.

Plan for seasonal swings. Summer weeks sell at a premium, while shoulder months need creative marketing such as foliage weekends or remote-work specials. Nail that cadence, and Deep Creek’s two-season engine will keep cash flow smooth.

14. Roanoke, Virginia

Blue-Ridge basecamp with city-sized occupancy

Roanoke pairs mountain-town scenery with small-city infrastructure. Hikers chase sunrise at McAfee Knob, cyclists ride the greenways, and business travelers fill weekdays thanks to a growing healthcare and rail hub.

Median home prices sit near $200,000, while a well-staged three-bed Airbnb often grosses $25,000 to $30,000 a year. Because stays spread across all twelve months, cash flow feels smoother than in pure resort markets.

Licensing takes one extra step. The city grants one non-owner-occupied permit per block, so you will file a Special Exception application and meet with planning staff. Approvals are common, and once secured the next owner can reapply without facing a numeric cap.

Choose walkable neighborhoods near downtown breweries or the Blue Ridge Parkway ramp. Add secure bike storage and fast Wi-Fi, and you will attract both weekend adventurers and midweek consultants, maximizing occupancy in a market still overlooked by many investors.

15. Bryson City, North Carolina

Underrated gateway to the Great Smokies

Bryson City sits twenty minutes south of Gatlinburg and offers a quieter base on the North Carolina side of the park. Visitors ride the Great Smoky Mountains Railroad during the day, then return to riverside cabins that feel miles from Pigeon Forge’s lights.

That dual character favors investors. Median home prices hover around $350,000, while nightly rates often reach about $250 for a modern two-bed cabin. With trout season, vibrant foliage, and steady park traffic, calendars remain full.

Local rules help rather than hinder. Swain County issues short-term-rental registrations without a cap and lets the license stay with the property at resale. The town has discussed noise limits, yet leaders focus on enforcement, not prohibition.

Inventory is slim, so act fast when a view-heavy lot appears. Add a firepit, reliable Wi-Fi, and a porch swing facing the river, and Bryson City can deliver Smoky Mountain returns without Smoky Mountain crowds.

Conclusion

These 15 mountain towns combine robust rental revenue with permits that pass seamlessly from seller to buyer, giving investors the rare chance to build reliable cash flow today and protect resale value tomorrow.