Every parent dreams of giving their child the best possible future! From their first day of school to the proud moment when they wear the convocation cap, each milestone is worth planning for.

But with education costs soaring, turning those dreams into reality can feel a bit overwhelming.

So, if you’re also worried about your child’s future, it’s high time you should invest in a child investment plan and reap the benefits down the line – curious to know how it works?

Keep reading, and by the end, all of your queries will be answered!

Possible Reasons – Why Do You Need a Child Investment Plan?

Let’s talk on the real ground, life around us is getting expensive!

So there are chances that if you don’t invest in a good child investment plan right now, your child might not be able to pursue his/her dream course from the preferred university.

Therefore, here are some reasons other than this why you should invest in a reliable child investment plan:

Rising Education Expenses

Whether it is a general side-by-course or a full-fledged degree, the price tags are sky-high. So if you don’t start saving today, you might not be able to afford the best education for your child by then.

Sense of Security

Having a right child investment plan gives you a sense of security because knowing your child’s future is financially safe, it brings an unsaid comfort to the parents.

Flexibility

Another notable reason to invest is the flexible ability to withdraw small chunks of money when needed.

For instance, if your child is good at dance or badminton, you might want him/her to learn it professionally. You can withdraw a small proportion of the amount from the plan and let your child’s passion thrive.

By having an investment plan, you’re just not saving money – you’re buying a sense of security for your child’s future.

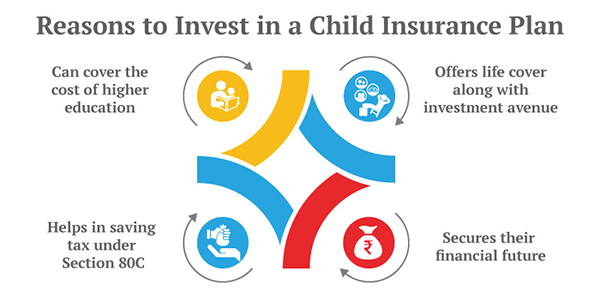

Do You Know?

Investing in a child insurance plan can prove to be extremely beneficial. The infographics below depict the top reasons to invest in a child insurance plan.

Checklist of Things to Tick Off While Choosing a Child Investment Plan

By now, you know why parents should have a reliable child investment plan, but do you know how to pick the right plan? Here’s your quick checklist to tick off:

- Start Investing Early: The earlier you start, the more money you’ll have by your child’s milestone.

- Understanding your Plan Type: Always make sure to check what your plan type is, and be clear on what you’re signing up for.

Additionally, always ask the agent if you can withdraw small chunks of money during your plan, as it’ll come in handy during your child’s milestones.

- Trust the Brand: While we agree that the plan’s benefits and numbers are really important, so is the reputation. So, make sure to go with only the trusted names with a solid track record.

What to Look for in a Child Investment Plan?

Signing up for a good investment plan can be a tough decision to make.

While we agree that the best child plan varies upon individuals’ needs, there are still some non-negotiable factors. So here’s a compiled list of things that a reliable investment plan must have:

- Return vs Risk: Don’t always look for high returns, find the right balance between steady growth and safety.

- Maturity Benefit: Look for what your child will get after the plan, make sure the amount aligns with your goals (graduation, post-graduation, wedding, and more).

- Partial Withdrawals: As mentioned, always look for a plan that offers the flexibility to partially withdraw some amount of money when needed.

- Some Add-ons: Nowadays, some investment plans offer some add-ons alongside, such as accidental coverage, health benefits, and more.

BONUS – How to Choose the Best Child Investment Plan?

Here’s a golden rule that will always come in handy! Your plan should match your child’s primary goals, and not just your convenience and budget.

For starters, ask yourself, followed by discussing with your child, and figure out when they would actually need the money. As a next step, decipher and comprehend the type of degree they’re willing to pursue, how much it would cost, and whether it is within your budget or not.

After having a clear answer to all of these, then search for different plans, compare multiple ones, and if required, consult a financial advisor!

Pro Tip: Compare different plans, and make a pros and cons list, it has always been the best practice to choose between two options. Because at the end of the day, your child deserves the best.

Wrapping Up!

Investing in a child investment plan is not just about monthly deduction of EMIs and numbers, it is more about the behind thought, vision, and the responsibility. So the earlier you start investing, the more money you’ll have by the end of your plan.

What is the right time to start a child investment plan?

Short Answer – As soon as possible

For example, if a parent starts a plan when the child is 5 years old and the aim is to cover their college costs at 18, the parent could pay ₹10,000 every month for 13 years.

What health care expenses should I plan for my child?

Plan for routine check-ups, emergency medical costs, and ensure adequate health insurance coverage.

How can I manage my family’s budget effectively?

Create a detailed budget, track expenses, and allocate funds for savings and investments.