- Understanding Your Travel Needs

- Dive into the Coverage Details

- Consider the Exclusions

- Determine the Claim Process

- Assess Financial Limits

- Check Reviews and Recommendations

- Understanding the Deductibles

- Consider Trip Duration and Frequency

- Look Into Specialty Coverage

- Factor in Family and Group Policies

- Examine Secondary vs. Primary Coverage

- Check for 24/7 Emergency Assistance

- Factor in Policy Extensions

- Note Reputation and Financial Stability

Traveling is a thrilling experience, opening the door to new cultures, sceneries, and unforgettable memories.

But like any adventure, it comes with its share of risks. If it’s a flight delay, an illness, or a lost suitcase, circumstances can throw a wrench in your meticulously planned journey.

This is where travel insurance can be a game-changer. But how do you choose a policy for your needs? When sources like Forbes Adviser offer a side-by-side comparison of travel insurance, it’s vital to know what aspects to consider.

In this guide, we’ll walk you through the steps to compare and select the one for your next escapade.

Understanding Your Travel Needs

Before diving into comparisons of the best travel insurance, identify your trip needs.

Are you planning a single trip or multiple trips in a year? Will you engage in high-risk activities like skiing or scuba diving? Are you traveling domestically or internationally?

Answering these questions will determine the kind of coverage you should look for.

Interesting Fact:

Men are 8% less likely than women to take out insurance.

For instance, if you’re an avid traveler, you might benefit from an annual multi-trip plan rather than buying a single-trip policy every time.

On the other hand, if your vacation includes adventure sports, you may need a policy that covers these specific activities.

Dive into the Coverage Details

Broadly speaking, its policies can offer:

- Trip Cancellation or Interruption Coverage: This compensates you if you need to cancel or cut short your trip due to circumstances like illness or natural disasters.

- Medical Coverage: If you fall ill or get injured during your travel, this plan will cover your medical bills. This is especially decisive when traveling internationally, where medical costs can skyrocket.

- Baggage and Personal Belongings Coverage: This compensates for lost, stolen, or damaged luggage and personal items.

- Emergency Evacuation: If a serious event, like a disaster or political unrest, happens during your trip, this will pay for your swift evacuation.

Ensure the policy you consider covers the areas most important to you. For example, if you’re traveling with camera equipment, prioritize baggage and personal belongings coverage.

Consider the Exclusions

Every insurance policy comes with exclusions. These are circumstances or events that the plan won’t cover. Common exclusions include:

- Pre-existing Medical Conditions: If you have an ongoing medical condition, some policies might not cover any complications arising from it during your travels.

- Adventure Sports: Many standard policies don’t cover high-risk activities like paragliding or bungee jumping.

- Travel to High-Risk Areas: If you’re traveling to areas with ongoing conflicts or high crime rates, standard policies might not cover you.

It’s vital to read the fine print and understand what’s not included. If an exclusion is a deal-breaker, search for policies or add-ons that cater to your needs.

Determine the Claim Process

If you need to make a claim, the process should be as hassle-free as possible. Factors to consider include:

- Documentation: Understand what documents the company requires for a claim. Some might need medical reports, police reports, or receipts.

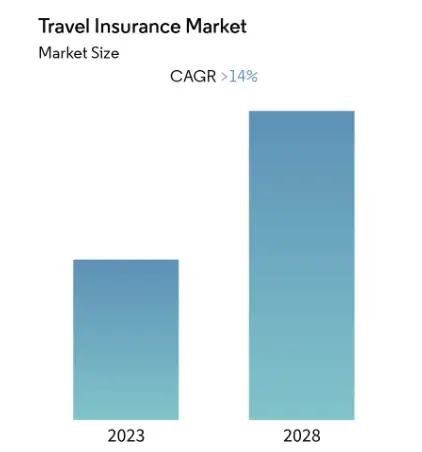

Statistics: In the past, the estimates revealed that the global travel insurance market reached a USD 13.9 billion value in 2021.

- Timeline: Check how long the insurer takes to process claims. You wouldn’t want to wait months for reimbursement.

- Customer Support: Opt for insurers known for their prompt customer support.

Assess Financial Limits

Most policies will have a maximum limit they’re willing to pay out. If your potential medical bills or the value of your belongings exceeds this limit, you might be left out of pocket.

Always ensure the financial limits of your chosen policy align with your expenses.

Check Reviews and Recommendations

When comparisons and assessments are essential, it’s also beneficial to see what other travelers are saying.

Online reviews, trip forums, and recommendations can give you insights into the reliability and efficiency of a company.

Always consider feedback from sources to get a balanced view.

Understanding the Deductibles

Deductibles refer to the amount you’ll have to pay out-of-pocket before your plan starts to cover costs.

For instance, if your bills amount to $2,000 and your deductible is $500, the plan will cover $1,500.

Lower deductibles mean you’ll pay less upfront, but the policy might be more expensive. It’s a balancing act between costs and potential expenses.

Consider Trip Duration and Frequency

The length of your trip and how often you locomote can influence the type of policy that’s right for you.

For instance, a week-long getaway might not demand as extensive a plan as a three-month trek across Asia.

Moreover, if you’re someone who frequently embarks on short trips, be it for work or leisure, investing in an annual multi-trip policy might be cost-effective in the long run.

Conversely, if you move on once a year or every couple of years, a single trip policy tailored to that journey’s needs would be appropriate.

Look Into Specialty Coverage

Sometimes, generic plans might not cover a few requirements. For instance:

- Cruise Coverage: Cruising presents unique challenges like port cancellations or onboard medical emergencies. Special cruise plans can cater to these specifics.

- Student Travel Insurance: For students studying abroad, this might offer a sum for durations and even include tuition protection.

Do You Know?:

The average cost of travel insurance in the U.S. was $148.

- Senior Travel Insurance: Tailored for travelers, these policies often account for age-related medical needs and conditions.

If you have motion circumstances, it might be worth exploring plans that cater directly to your situation.

Factor in Family and Group Policies

Traveling with family or as part of a group? Instead of individual policies, you might benefit from family or group trip coverage.

These policies can often provide plans for people under one premium, which might be cheaper than everyone getting separate policies.

Also, family policies might offer added perks for children traveling with adults.

Examine Secondary vs. Primary Coverage

It can be both primary or secondary: The primary plan acts as your key coverage and will pay for expenses directly without you needing to use any other security.

Secondary insurance kicks in after other forms of allowances (like your regular health one) have been exhausted.

When the primary one might be more expensive, it can offer faster claims processes and a broader plan.

Understand the difference and decide which one aligns with your requirements.

Check for 24/7 Emergency Assistance

When disaster strikes, you don’t want to be held up by time zones or business hours. Ensure the provider offers 24/7 emergency assistance.

This service ensures that no matter where you are or what time it is, you can get help from your provider.

Factor in Policy Extensions

Sometimes, adventures take turns. Maybe you decide to extend your stay, or perhaps an unforeseen circumstance delays your return.

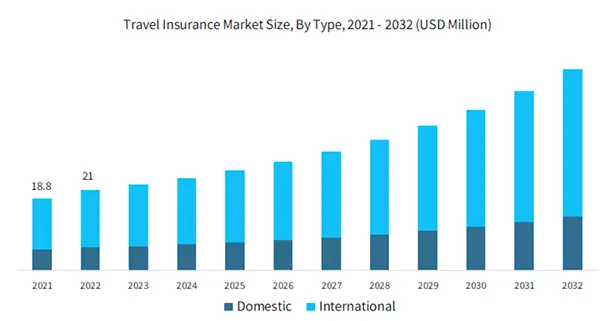

Statistics:

According to the latest estimates, the travel insurance market from the international segment reached USD 15 billion in revenue in 2022 and is further set to grow over 10% CAGR from 2023 to 2032.

It’s decisive that your coverage can adapt to changes. Check if the provider allows for policy extensions should your trip last longer than initially planned.

Note Reputation and Financial Stability

It’s vital to choose a provider with a reputation and financial stability.

In the event of a large-scale disaster or a situation where travelers are making claims simultaneously, you’d want to ensure your insurer can handle multiple payouts.

Researching the financial health of a company can give you insights into its stability.

Several global rating agencies, such as Moody’s, A.M. Best, and Standard & Poor’s, provide ratings based on the financial strength and potential longevity of insurance companies.

Overall, when the thrill of adventure calls, ensure you’re safeguarded against potential mishaps.

By following this guide and making an informed choice, you can focus on creating memories and exploring new horizons, knowing that you’re well-prepared for any twists in the tale. Safe travels!