As we prepare to embark on an international journey, one significant question tends to linger: should we carry cash or rely on cards for our spending needs? This debate is as old as the concept of travel itself.

Each method carries its unique advantages and potential pitfalls, and the choice between the two often hinges on various factors such as destination, personal preference, and the nature of your expenses.

Let’s unravel this financial conundrum and dive into the pros and cons of using cash while globetrotting.

The Advantages of Using Cash While Travelling Internationally

A lot of people prefer to stick to cash, as it is the more traditional way of making transactions. If you are one such individual, there are a few perks that come with carrying physical money while navigating foreign lands.

Immediate Accessibility

One of the most significant advantages of carrying physical money is its immediate accessibility.

Unlike plastic money, cash has no dependency on technology, so there’s no need to scout for ATMs or worry about online bank compatibility with local machines.

It’s universally accepted, and you can pay for goods and services on the go without any hassle.

Better Budget Management

Cash can also facilitate better budget management when traveling internationally. With a finite amount of money in your pocket, it’s easier to keep track of your expenditure and prevent overspending.

Moreover, using physical money can help you avoid possible international transaction fees that could accumulate on a card.

TRAVEL TIP

It is best to carry one credit card and a sufficient amount of cash at all times. Leave a second credit card in a safe place, maybe at your hotel for emergencies.

Helpful in Emergencies

Finally, cash can be a lifesaver in emergencies. In case of unexpected situations such as loss of luggage, power outages, or internet downtime affecting digital banking services, having some offline money on hand can ensure you’re not left stranded.

Widely Accepted

Of course, one of the most apparent advantages of cash is that it’s widely accepted, even in remote locations with limited technological infrastructure.

This makes it a convenient and reliable payment method when visiting off-the-beaten-path destinations.

However, while carrying currency presents distinct advantages, it doesn’t come without its share of potential drawbacks. We’ll explore those in the following section.

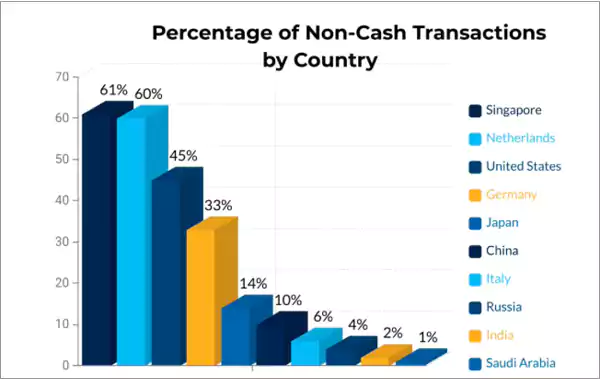

Though both cash and credit have their pros and cons, it also depends on the varied payment modes available in the country you are visiting. The graph below shows the countries that use non-cash transactions; Singapore is at the top since the basic cost of traveling and accommodation is higher over there.

The Disadvantages of Using Cash While Travelling Internationally

Some people prefer to stick to digital transactions, as they find them more convenient and safe. While the following drawbacks may not apply to every traveler, it’s relevant to consider them when deciding on your preferred payment method while abroad.

Security Risks

Carrying a significant sum of ready money with you can make you vulnerable to theft or personal harm in case of unfortunate events. It could also be challenging to keep track of the various currencies and denominations, which could lead to confusion and mistakes.

Limited Protection

Unlike online credits, cash does not have any protection against loss or theft. If you lose your money, it’s gone for good. On the other hand, most credit and debit cards offer some form of fraud protection and can be easily replaced if lost or stolen.

No Transaction History

Currency transactions do not leave a paper trail, making it challenging to keep track of your expenses when you return home. Without a record of your spending, it could be difficult to create an accurate budget or dispute any discrepancies in charges.

Exchange Rate Fluctuations

When traveling between countries with different currencies, using funds can expose you to exchange rate fluctuations. This could result in you paying more for goods and services than initially intended.

Crown Currency is a reliable option to consider when exchanging currency, as it offers competitive rates and has a reputation for excellent service.

The Middle Ground: Using Both Cash and Cards

As with most things, the best approach to using cash or credit cards while on a tour is opting for a balance between the two methods.

It’s generally advisable to carry some physical money for emergencies and smaller transactions while using plastic money for significant purchases or payments requiring a paper trail.

Moreover, it’s always wise to inform your bank and credit card company of your travel plans for personal or business requirements to avoid any unexpected account freezes or declines while abroad.

You should also research the local currency and have an idea of the exchange rate before departing.

Conclusion

There is no one-size-fits-all answer to the cash vs card debate in international travel. The right approach depends on your personal preferences, destination, and expenses.

Hopefully, this guide has shed some light on the pros and cons of both methods, helping you make an informed decision for your next adventure abroad.

In case you prefer the convenience of digital transactions or the security of ready money, it’s always wise to have a combination of both payment methods while traveling internationally.

This way, you can enjoy the best of both worlds and have peace of mind knowing you’re prepared for any situation that may arise.

Ultimately, the most relevant thing is to do your research and plan accordingly for a stress-free and enjoyable trip abroad.