Dreaming of faraway places or relaxing breaks? However, the financial commitment involved in exploring new regions often ends with a significant hurdle, pushing such aspirations into the world of delayed plans. Meanwhile, modern financial solutions can turn your dreams into reality.

In a recent survey conducted by Paisa Bazaar, the first half of 2023 revealed that a notable 20% of individuals opting for personal loans utilised funds specifically for travel-related expenses. (Source: TOI)

This growing trend shows a shifting system where financial flexibility is becoming key to unlock memorable adventures.

Travel loans truly emerge as a fine tool designed to fill the gap between wonderlust and reality. It is an easy way to have flexible financing to see the world without spending all your savings right away.

Let’s learn more about travel loans in this article.

KEY TAKEAWAYS

- Travel loans are specifically developed to cover trip-related expenses, enabling diverse travelers.

- It’s a simple online application process for quick approval with minimal documentation, especially for those with good credit.

- These loans are usually unsecured, which means that no collateral is required and funds are disbursed directly into your account within 1 to 2 days.

- Travel loans offer broad coverage for expenses including flights, accommodation, visa fees, local activities, and even souvenirs.

- Borrowers can benefit from adaptable repayment options between 6 months and 5 years according to their financial capacity.

- Lastly, it is crucial to borrow wisely after checking fees, avoiding over-borrowing, ensuring steady income for the payment, and carefully reviewing all terms and conditions.

A Travel Loan is Given Especially to Pay for Trip Costs:

A travel loan allows you to take a family holiday, a solo backpacking trip, or a romantic getaway without sacrificing your funds. Several financial advantages result from the smooth online applications that many lenders provide for trip loans.

Particularly if your credit score is excellent, you could secure approval in just a couple of hours with very little documentation. Typically, travel loans offer adaptable reimbursement choices ranging from six months to five years, depending on the lender, in addition to travel insurance. This lets you pick a program just right for your needs.

INTERESTING FACT

“Travel loan is a new term in the realm of financial loans, which became more formalised and widely available in the late 20th and early 21st century with the increase of digitalisation.”

Since a Travel Loan is an Uncollateralized Loan,

It does not require a guarantee, which means that you can guarantee your travel without any financial risk. Usually, between 24 and 48 hours following authorization, the loan amount is deposited into your account, so it is suitable for last-minute travel plans. Visa costs, local events, travel insurance, gift and souvenir purchases; your adaptability guarantees you will not forgo any component of your trip as a result of financial restrictions; travel loans cover all aspects of your trip. Before seeking a travel loan, keep in mind these several points. Although vacation loans have some rather good benefits, wise borrowing is necessary.

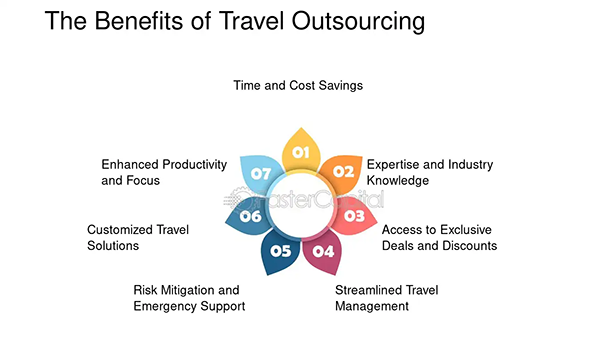

But before moving forward to the application and authorisation process, you must take a quick look at the benefits of borrowing a travel loan. This may help you control the areas you are supposed to spend.

A Few Significant Ideas are

Seek out minimal requirements and affordable pricing to prevent hidden charges. Over-borrowing can result in unnecessary financial struggle when the debt is settled; only take what is needed. Before submitting an application for a loan, be sure you have a reliable income and a specified repayment plan.

Review the conditions extremely thoroughly. One ought to understand early repayment charges as well as late payment penalties. One travel loan might be your gateway to exploring fresh air using a passport. So that one can visit new locations and make memories devoid of a financial load. Follow these easy but effective tactics for controlling travel expenses, thus you may enjoy your holiday carefree.

A travel loan might be the secret to fulfilling any dream, if you wish to see the Eiffel Tower, the beaches of Bali, or take a cross-country trip. Right away, check out travel loan options as you get ready to depart and start your follow-up trip.

Is a travel loan secured or unsecured?

A travel loan is a specific type of personal loan designed to cover various expenses associated with a trip, such as flights, accommodation, visa costs, local activities, and even souvenir purchases.

Is a travel loan secured or unsecured?

Travel loans are typically unsecured, meaning you do not need to provide any assets as collateral to guarantee the loan.

How quickly can I receive the funds after approval?

For most lenders, the approved loan amount is deposited directly into your account within 24 to 48 hours, making it suitable for both planned and last-minute travel needs.

What types of travel expenses can a travel loan cover?

Travel loans offer wide adaptability, covering virtually all aspects of your trip, including visa costs, airfare, hotel stays, local events, travel insurance, and even gift or souvenir purchases.